Alright, it’s our second week. We’re getting right to business. Enjoy our content? Refer a friend and we’ll send you free stuff. New to ROT? Check out our first newsletter 📈 Laying The Foundation 📈 |

|---|

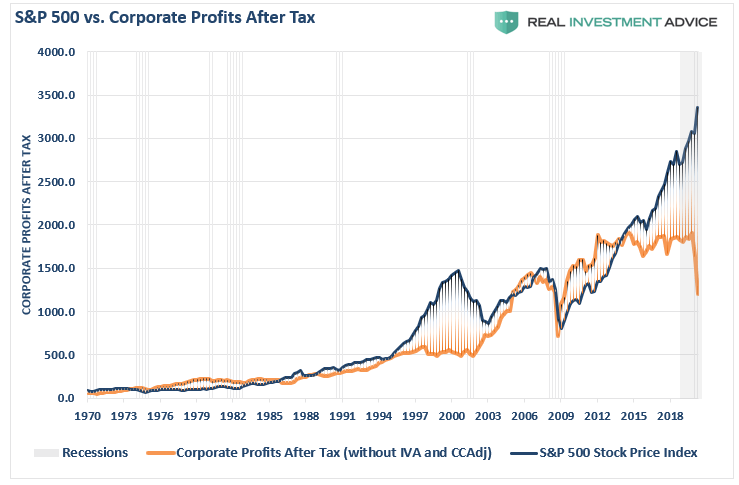

Click here if these just look like random letters to you! VALUATIONS MATTER: Top 4 US equity market valuation indicators, updated weekly with commentary. S&P500 HITS ALL TIME HIGHS… meanwhile the economy is still in the toilet. BETCHA DIDN’T KNOW… corporate profits have been flat for years. What has driven profit growth in the S&P500? Buybacks, lower tax rates, and other forms of financial engineering. Mainly buybacks. What are buybacks? Learn more in our knowledge base. The graph below shows the S&P500 storming higher (blue) while corporate profits after tax have been flat and now declined as a result of the recession. Food for thought.

OK BIG TECH DOMINATES, NOW WHAT? There is still plenty of long term investing opportunity in the US. To begin, we have seen growth businesses (like Facebook, Google, and Amazon) dominate the markets the last 10 years. Since the end of 2016, growth stocks have returned ~100% whereas value stocks (knowledge base) have returned just 15%. COVID19 IS NOT A FOREVER EVENT. The S&P500 may be hitting new all time highs but many sectors are not doing well and that is where the medium/long term opportunity exist. The most basic question to ask yourself is this: are people really never going to eat out again? Are we really never going to use gas again? Are banks becoming worthless companies that provide no value? Are humans not social animals that thrive on social contact? Will we really never, ever leave the house again? PERFORMANCE OF SPECIFIC SECTORS OF THE S&P500: Energy Sector (XLE) – Still down 38.64% year to date due to changes in demand for oil during COVID. The risks are very real yet it presents an interesting opportunity in the long run. Real Estate Sector (XLRE) – This ETF tracks the real estate sector and is still down 8.10% year to date. Real estate presents strong investing opportunities but requires careful vetting to avoid the massive risks with commercial real estate like office buildings. Equal Weight S&P500 (RSP) – This ETF tracks all stocks in the S&P500 equally so each of the 500 companies in this index carry a 0.23% weight in this fund. As a result, this ETF is still down 10.58% year to date and has been generally stagnant since 2018. High Dividend S&P500 Fund (SPYD) – This ETF invests in 60-80 high yield S&P500 stocks that includes companies like General Mills, Gilead Sciences, and AbbVie. This fund is underweight tech and overweight many industries that have fared poorly in the pandemic. Still down 28% YTD with a 5.98% dividend yield, this could present a buying opportunity for investors looking long term and beyond the COVID pandemic. BOTTOM LINE: History shifts and an investment that delivers strong returns one decade may not deliver strong returns the next decade. During the height of the Dot Com Bubble in March 2000, growth stocks outperformed value stocks over the prior 1, 5, 10, and 15 year periods. By March 2001, value stocks regained the advantage over every one of those periods. With valuations in tech stocks as high as they are today and Congress eager to further regulate and potentially break apart these large tech businesses, we’re personally balancing our portfolio with strong value stocks/ETFs that are quite cheap relative to tech stocks instead of doubling down on extreme valuation tech stocks. Now, if tech stocks go back on sale like they did in March 2020, there may be some good opportunities but for now… probably not. |

|---|

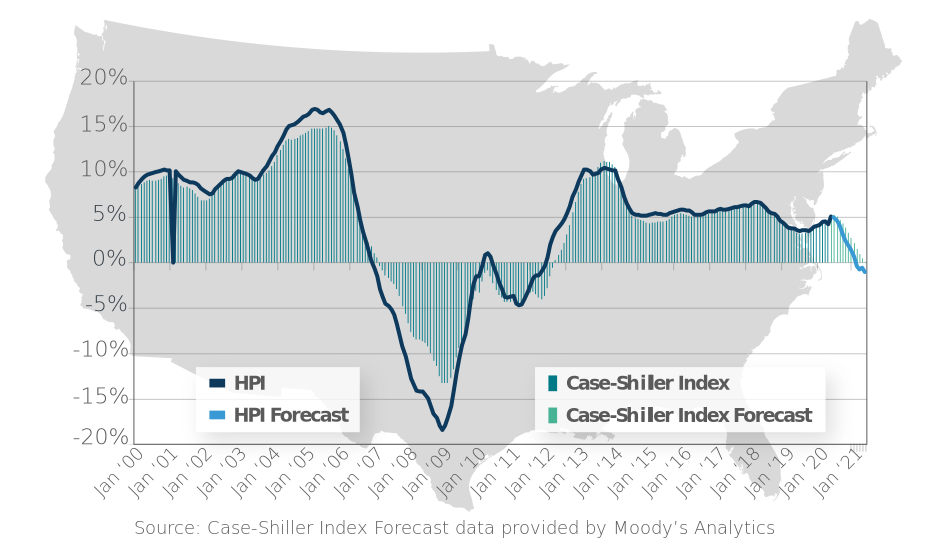

IS THE PANDEMIC REALLY CHANGING THE WAY WE BUY HOMES? We keep hearing this – the pandemic is shifting home buying from urban to suburban centers. This is (mostly) not true! Zillow recently released a report that shows the housing market has been improving in both suburban and urban areas in nearly all areas (minus places like NY & SF where home values have fallen by at least 4% year over year). HOUSING PRICES HAVE GONE UP 4.9% SINCE JUNE 2019, WILL THEY GO DOWN BY JUNE 2021? CoreLogic published their most recent US National Home Price Index showing that home prices increased by 4.9% in June 2020 compared to June 2019. In addition, CoreLogic is now forecasting a 1% decline in housing prices by June 2021. In the prior report, CoreLogic was original forecasting a 6% decline in housing prices by June 2021 so this is quite an improvement in a report published only 30 days later. Still, this will represent the first potential decline in US national housing prices in 9 years.  BUT… MILLENNIALS WANT HOMES: Just a few years ago, the mainstream thinking was that millennials would no longer live in the suburbs or even buy homes as often as the previous generation. WRONG! This year, nearly 50% of all home buyers are expected to be millennials and this will likely only increase from here. We want HGTV homes and we want them now! Millennials comin’ in hot, even after living through 2 of the greatest recessions in US history. BOTTOM LINE: The seriously conflicting data continues! On one hand, housing prices are up and only projected to slightly decline by June 2021. On the other hand, ~16% of FHA mortgages and ~8% of conventional mortgages are in forbearance. For this situation to correct itself, either housing prices will come down or the number of mortgages in forbearance will decline and the recession and pandemic will resolve more quickly than we think today. The verdict is out for now, but we’re taking a cue from banks and guessing home prices may decline/stagnate in the short term once all the government stimulus expires. After the recession subsides, housing should continue doing well because millennials are finally at prime purchasing age. |

|---|

REFINANCING YOUR MORTGAGE WILL COST ~$1,400 MORE BEGINNING SEPTEMBER 1ST: Rates are lower than ever before and people have been increasingly refinancing their mortgages for months. Beginning September 1st, the 2 largest mortgages companies that buy or back most home loans in the uS are charging an “adverse market refinance fee” equal to 0.5% of the loan amount. Why? Freddie Mac says its all because of “COVID-19 related economic and market uncertainty.” If you’re in the middle of closing a refinance, get it done ASAP! If you’re still looking to refinance, make sure you use NerdWallet’s Mortgage Refinance Calculator. With rates as low as they are, refinancing is still worthwhile in many cases. SHOULD I BUY A HOME? Buying a home is a highly emotional decision that goes far beyond a typical investment. Really, housing is not an investment. Your home is where you live and everyone needs shelter. But, there is a few ways to think through it if you’re in the market for a home.

BOTTOM LINE: It’s a tricky time to buy a home yet life can’t simply stop due to a recession or pandemic. Before making such a large financial decision during an economic crisis, make sure you are well prepared for all the possibilities and build in serious margins of safety. Better safe than sorry! |

|---|

Don’t just check your FICO® Score, Boost it instantly for Free For the first time ever and only with Experian, you can increase your credit scores fast by using your own positive payment history. Experian Boost is completely free, no credit card required! It can also help those with poor or limited credit situations. Other services such as credit repair may cost you up to thousands and only help remove inaccuracies from your credit report. Results may vary, see Experian.com for details |

|---|

Last week, we posted a video with too much content. This week, we’re breaking down that video for you. tl;dw (too long, didn’t watch):

|

|---|

Every week, we’ll point out a few of our favorite resources/articles/news that actually provide value. Value stocks trade at lowest value relative to growth stocks since 2001 – Growth stocks have been hot the last 10 years, will the trend remain the next 10 years? NYC is “dead forever” according to life long New Yorker James Altucher – A grim view on NYC after the pandemic, it’s an interesting perspective worth reading but we’re a lot more optimistic than this. While NYC will likely take years to recover, we believe American ingenuity will always drive us forward. Goldman Sachs has done the math and a national mask mandate to halt the spread of coronavirus would have a big impact on the U.S. economy – I know, I know. Masks are a sensitive topic. Take a read, decide for yourself. |

|---|

What did you think of our newsletter? Let us know, your feedback will help us improve the quality of our newsletter. 1 2 3 4 5 6 7 8 9 10 Certified 20 Have more to say? Want us to cover something specific? We’d love to hear from you. |

|---|

The best way to let us know you enjoy Return On Time is to share us with your friends, family, and colleagues. Best of all, you get rewarded with free swag! |

|---|

|

|---|