|

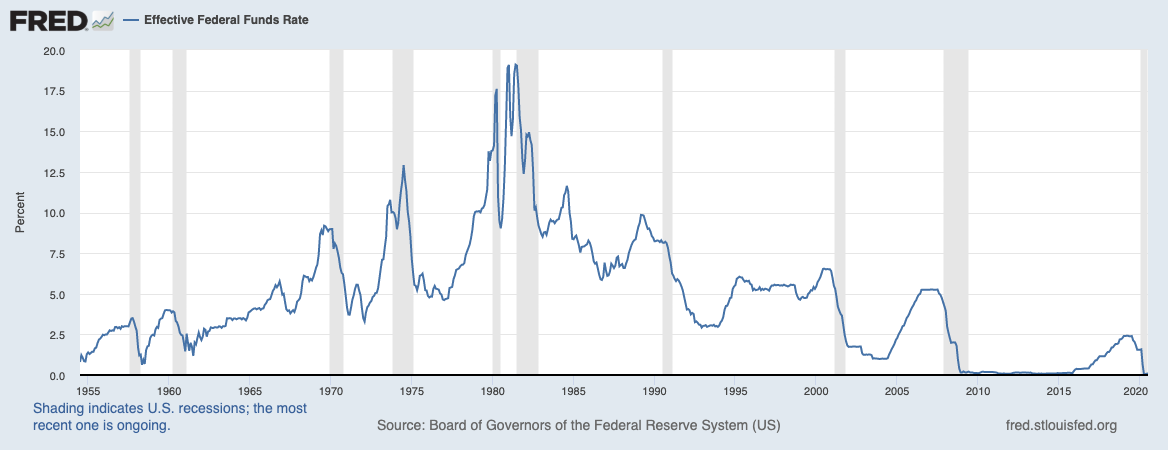

Since the Great Recession, the Federal Reserve has taken drastic measures to stabilize the economy. In response to the Great Recession, the Federal Reserve cut interest rates from a bit over 5% to 0%, conducted a number of large bailouts, kept interest rates at 0% for a significant portion of the recovery, and engaged in Quantitative Easing by taking its own balance sheet from $800B to $4.5T (pre pandemic peak balance) to stimulate the economy. While these actions did help stabilize the economy, the sheer actions also created various instabilities and economic distortions. This has led to new Government Sponsored Bubbles. The big question is, what is the likely outcome?

In a nutshell, here is how US stock markets have worked since the Great Recession:

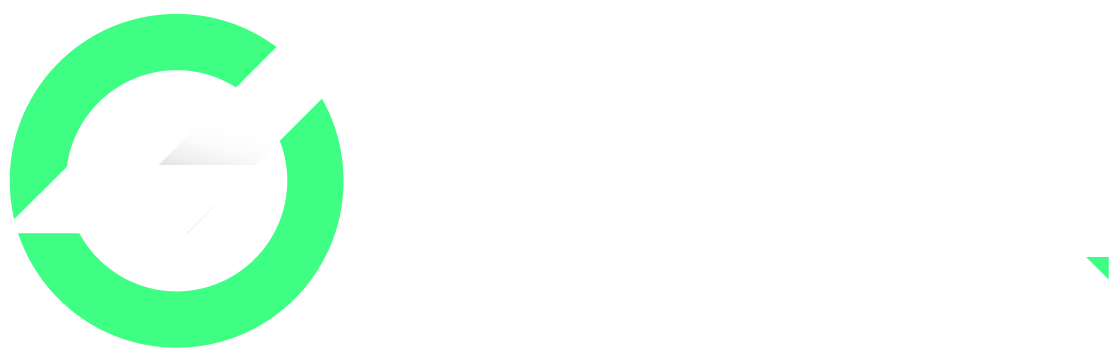

- The Fed cut interest rates to 0% and printed trillions in response to the Great Recession. Combined with low interest rates and Quantitative Easing, the US was (and still is) flush with extremely cheap money to stimulate the economy. Since the 80s, interest rates have only trended downwards to 0%.

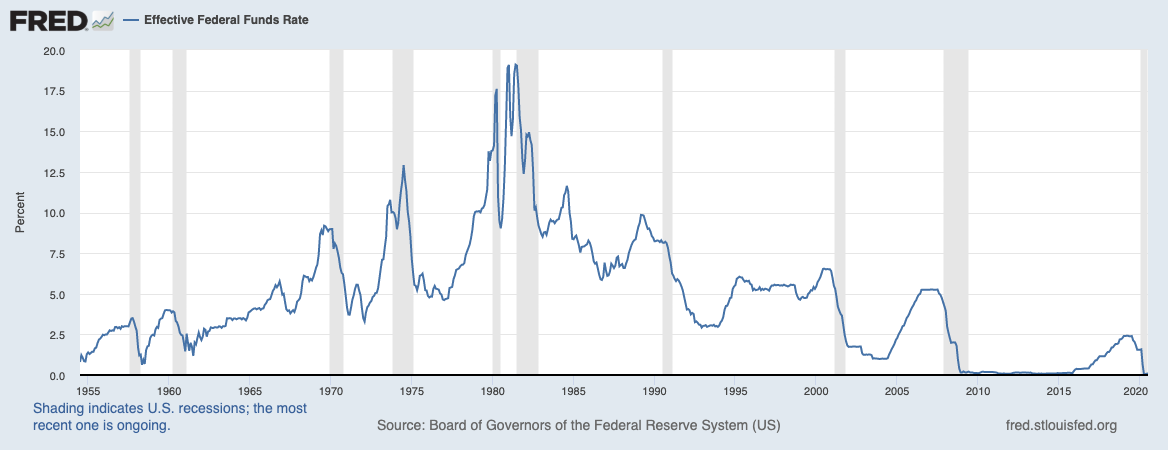

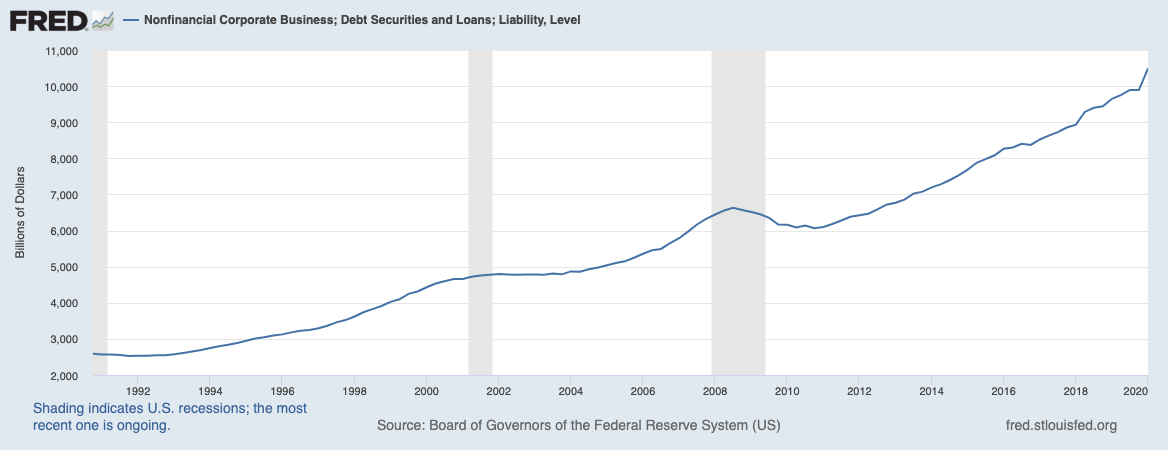

- Corporate debt went bonkers after 2009 and it’s still going bonkers. Today, US companies owe more than $10.5 trillion. Adding the debt of medium sized companies and businesses not listed on the stock exchange takes this to $15.5T or ~74% of the US GDP.

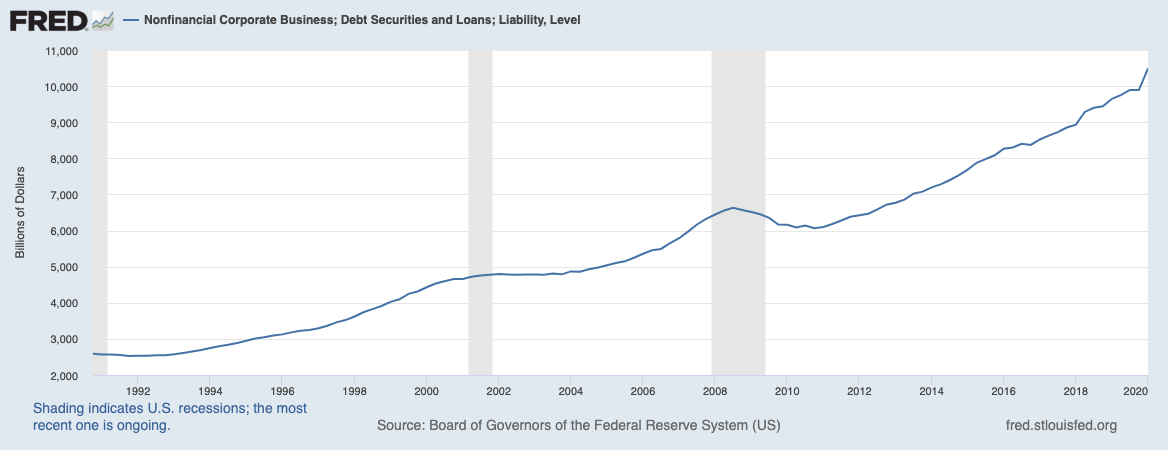

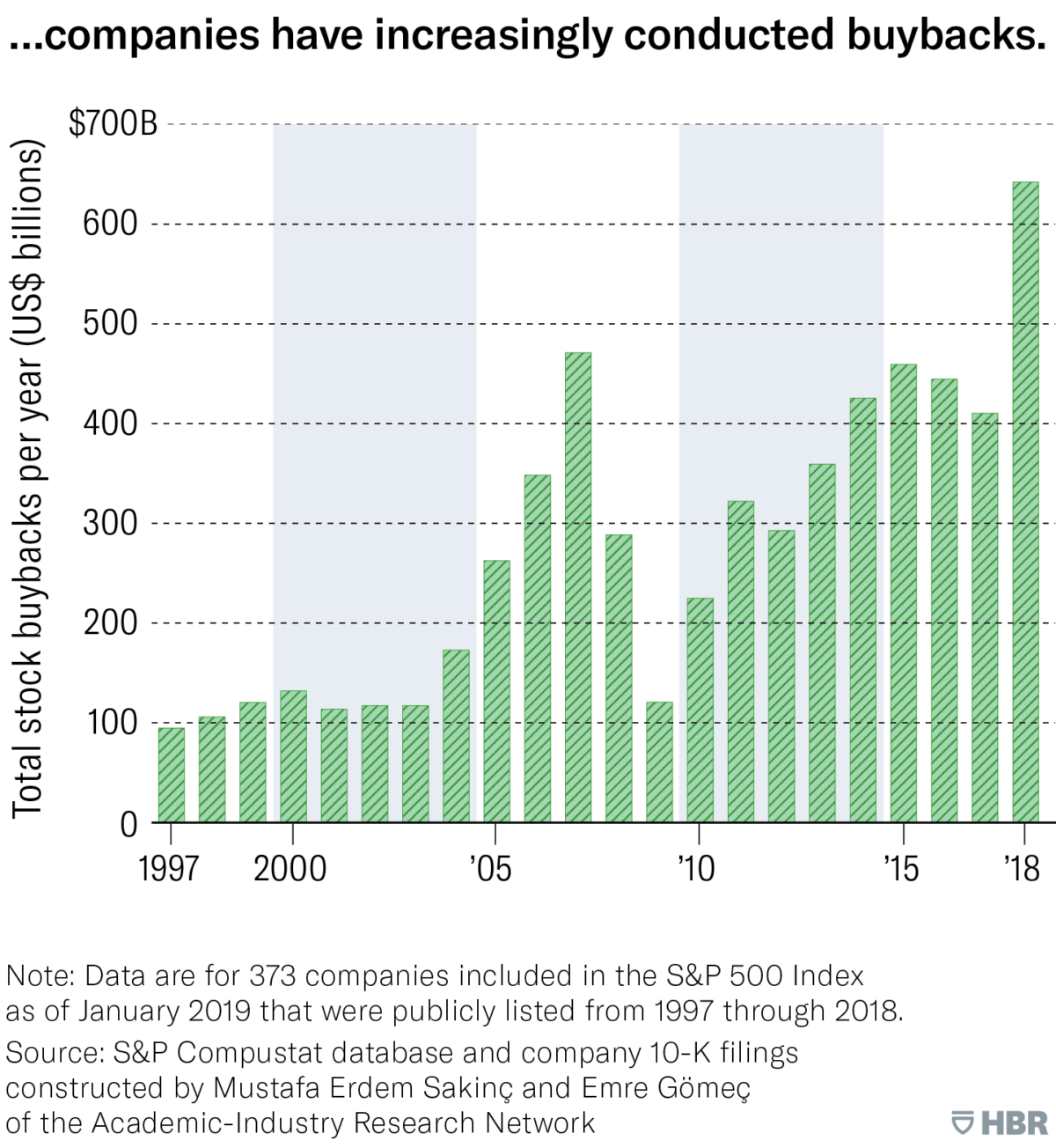

- Cheap debt fueled an explosion in stock buybacks. With a few winks, countless public companies paid for operations with debt and bought back stocks with profits. In 2019, Goldman Sach’s estimated that companies bought back $480 billion in shares and was the dominant source of stock buying. Harvard Business Review has a thought provoking article that’s worth a read if you’d like to explore this topic further: Why Stock Buybacks Are Dangerous for the Economy.

- Low rates distorted (and continue to distort) economic incentives. In 2005, you could earn a ~5% return risk-free by opening a Certificate of Deposit. Today, you can earn ~1% on a CD at special low cost banks like Ally. Risk-free bonds show a similar picture. Moreover, bonds in general are just not very interesting at the low interest rates we see them today. Low rates rob retirees, the average saver, and make stocks the only game in town.

- The 2017 Tax Cuts and Jobs Act reduced the top corporate tax rate from 35% to 21%. Tax cuts have juiced corporate profits at the expense of massively increased government debt. Higher profits drove stocks higher ultimately.

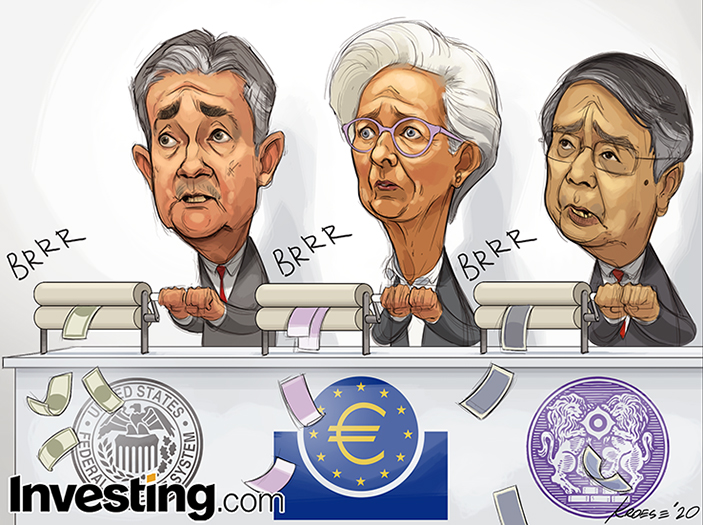

- The government printers went brrrrrr. The money supply has grown by the most in recorded Fed history. The money supply, as measured by M2, has now grown > 20% from $15.33T to end of 2019 to $18.3T at the end of July. For some laughs…

- Everything combined distorted markets … we’ve basically milked this cow thanks to Government Sponsored Bubbles. Check out our Valuations Pulse section to understand US equity valuations right now.

- Lastly, we did all of this at expense of long term, productive growth.

While these actions have helped serve as a temporary band aid, they created larger long term problems like growing wealth inequality, high government debt, lower economic growth, and asset bubbles ultimately. Since the wealth effect is a well known goal of the Fed, those with the most assets experience the wealth effect exponentially whereas those with few assets are left far behind.

How Are US Market Valuations Right Now (as of August 25th, 2020):

By nearly all measures, US stock markets are the second most expensive in history after the Dot Com Bubble in 2000. Bulls argue that stocks can go significantly higher because interest rates are low and there is no other place to invest. Bears argue that low interest rates indicate lower economic growth moving forward and stocks can’t beat gravity and will need to come down.

Here at Return On Time, we’ll let the bulls and bears hash it out while we invest in probabilities. At this point, it is possible that stock prices will remain elevated for years to come or that we could see another big crash anytime. Also, investing in bonds is fairly risky if rates start to increase from 0%.

Given the ongoing recession, extremely high stock market valuations, and massive on-going money printing, we start to look more towards hard assets like like gold, silver, oil (and other commodities), and real estate. Nowadays, some also look at bitcoin or other cryptocurrencies as being similar to gold.

Investing in Hard Assets

Investing in the 2020s is exceptionally difficult. A diversified portfolio is more important than ever and what has worked in the past likely will not work in the 2020s. For example, bonds are unlikely to produce a positive return from this point so they can’t be viewed as the safe haven they have been the last few decades. Given all the distortions, we view diversification as critical to success in the 2020s because the probabilities for various outcomes are significant. Hard assets are a good way to counter massive money printing which ultimately leads to some kind of negative outcome like currency devaluation or significant inflation.

Here is a few hard assets to consider:

- Gold: Gold has historically served as a form of currency. Until August 15th, 1971, you could exchange $35 USD per oz of gold. Since President Nixon officially removed us from the gold standard, gold prices have risen to $1900-$2000 per oz of gold. During periods of significant economic certainty or massive monetary experiments, gold prices tend to rise as investors seek to protect their capital. The best way to own gold is buying physical gold. If this is not possible, Sprott Physical Gold Trust (PHYS) can be purchased with a brokerage account. PHYS is interesting because the gold is fully allocated and can be redeemed (subject to high minimums aka 400 oz of gold minimum). While gold is very expensive right now after climbing the last 2 years, we may see a correction that creates points to purchase gold. Gold is a great way to protect your money from significant currency devaluation.

- Silver: Similar to gold, silver has been used as a currency historically. The best way to own silver is buying physical silver. If this is not possible, Sprott Physical Silver Trust (PSLV) can be purchased with a brokerage account. Similar to PHYS, PSLV is fully allocated and can be redeemed for physical silver (subject to high minimums).

- Oil and other commodities: Oil and other commodities can be used as a hedge against inflation. If all of this money printing is going to lead to currency devaluation ultimately, commodities may do well.

- Real estate: Real estate is an investment that generally does well long term. In 2020, it’s probably easy to step on a mine here but the right real estate investments that are geared with the future in mind are a great way to hedge against inflation and receive a return.

Bottom Line

Investing in the 2020s is going to be a complex game. We’re in the middle of a government sponsored bubble created by 0% interest rates, massive money printing, and various cause-and-effect distortions in the economy. However, bubbles can often go on for much longer than we’d expect. Thus, to be a disciplined investor, it’s important to consider a wide range of probabilities and outcomes. Hard assets can be a valuable addition to a diversified portfolio as a hedge against currency devaluation and continued money printing. |