|

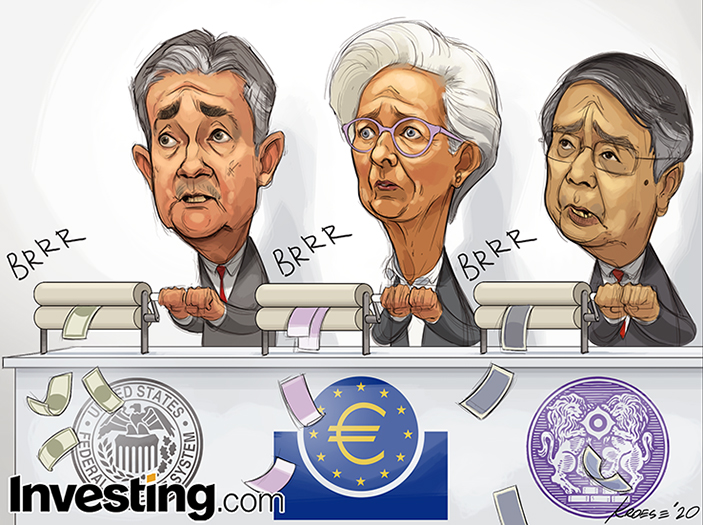

Printing money has an eventual consequence: The US is the most powerful nation in the world and the USD is the most powerful currency in the world today. Thus, we’ve been able to print money endlessly recently with minimal short term consequences. However, our national debt is fast approaching $27T and most of the recent federal debt has been printed out of thin air by the Federal Reserve. So, the Federal Reserve adds a few numbers in their computer system and then buys Treasuries of various duration to finance the government. This is likely to continue for some time.

The money supply (as measured by M2) has increased massively since March 2020. The money supply has grown by 20% in just a few months (or basically by the most ever in recorded US history). Without a doubt, every dollar we own today is less valuable than it was just a few short months ago. If the crisis gets worse, we may see the money supply contract temporarily but rest assured, the Federal Reserve is ready to print some more.

How do we actually pay it back? We have some historical context for this. During and after WW2, the Federal Reserve had similarly printed vast quantities of money and spent the next few years inflating the debt away via a practice known as Yield Curve Control (YCC). Put simply, yield curve control aims to artificially control interest rates (lower) for government debt. By buying more debt with printed money, the Federal Reserve can forcibly keep interest rates lower than real interest rates. A negative real interest rate means that inflation is higher than interest rates. Eventually, part of the goal is that inflation will increase in a controllable manner. For context, by 1947, inflation was over 17% in just one year. Yield Curve Control is a likely reality as the Federal Reserve is actively discussing this and arguably already informally engaging in YCC. Negative real rates inflate debt away.

Then what? The government will still have a massive debt problem after everything is said and done. Most likely, we’ll see tax rates increase sometime in the 2020s to bring some level of control to the federal debt. Keep in mind that tax rate increases are likely to have an outsized impact on corporations and that may affect the stock market as well.

BOTTOM LINE: Ultimately, we don’t really have a choice as a nation but to keep printing money and controlling interest rates. The alternative options are much worse. The best option is to inflate away as much debt as possible over the course of times in a controlled manner. Given that, the US government will likely do whatever it takes to make this a reality. While these are extreme steps, we applaud the Federal Reserve for stepping up during the crisis and preventing tens of millions of Americans from economic ruin. However, it’s important to keep in mind that there is a price to pay for these measures in the future that may include growing wealth inequality further. |

|---|