Welcome to the first Return on Time Newsletter. ROT is a no-BS newsletter that cuts through the overly optimistic and overly pessimistic far-too-confusing media to deliver a balanced view backed with data so you can make profitable decisions. Return On Time Invested (ROTI) in 10 minutes a week. |

|---|

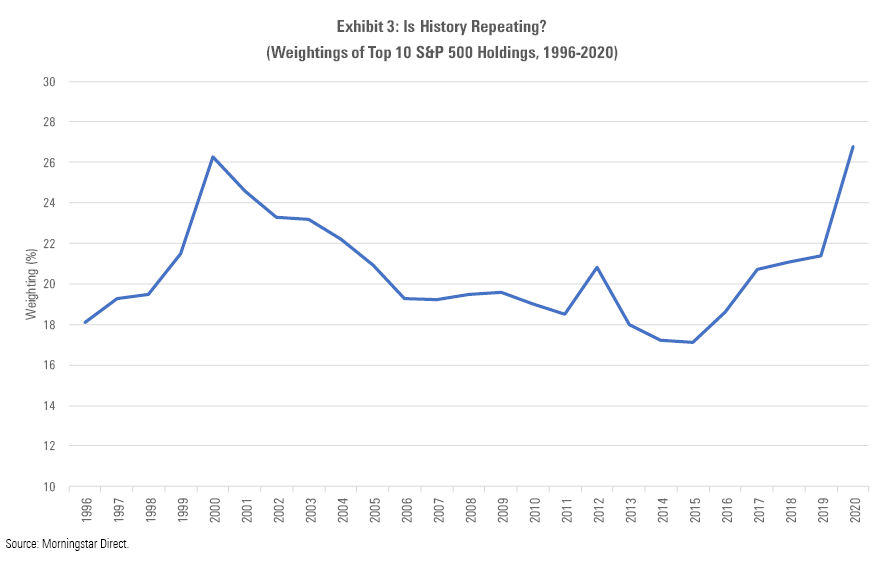

Click here if these just look like random letters to you! VALUATIONS MATTER:Valuation is a critical process of determining the current (or future) worth of an asset or a company. Today, the stock market is valued at levels last seen only in 1929 and 2000. While valuations don’t represent the return you receive in the short term, they do tend to accurately predict your 10 year return. Every week, we will keep a pulse on our top 4 US market valuation indicators. Just for reference, below is a graph showing the weightings of top 10 S&P500 holdings from 1996 to 2020.

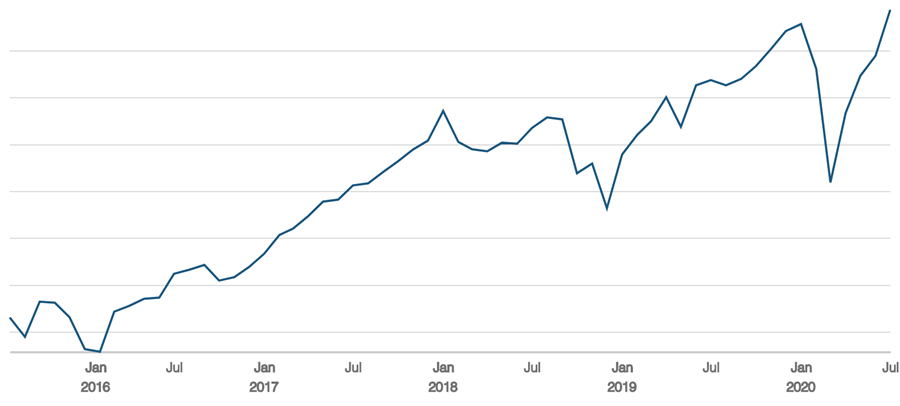

WORRIED? STAY INVESTED. It’s important to stay invested because timing the market simply does not work.There are many investors that are very upset that they panic sold in late March, locking in temporary losses as permanent losses. Here is a screenshot of one of my portfolios since late 2015 and while it’s up significantly, imagine if I had sold in late 2018 or during this current crash. My thesis is very simple – only deploy cash when an asset is valued fairly and never sell an asset you believe in even if it drops significantly (as long as the business fundamentals remain strong long term). Instead, buy more! |

|---|

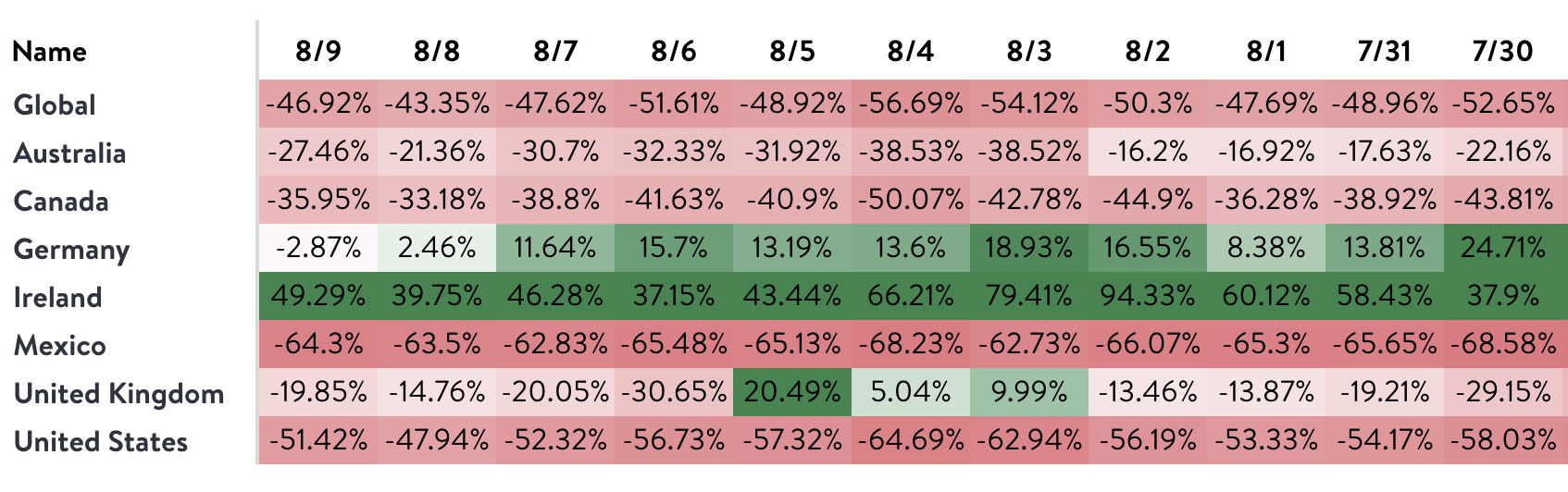

STR8 UP FACTS:

Other interesting economic data:

BOTTOM LINE: The US economy is resilient, even in the face of our pandemic and growing divide. The last few months are evidence of American ingenuity (as well as ignorance that is costing us). One of the biggest issues we face today is all the seriously conflicting data like a declining employment rate, yet the second highest week of Americans receiving unemployment. The data is concerning and there is serious questions and likely pain ahead, but first we really need to bring this pandemic back in control in the states. Maybe the bottom line is actually… consider wearing a mask to save your economy and the American people faster. |

|---|

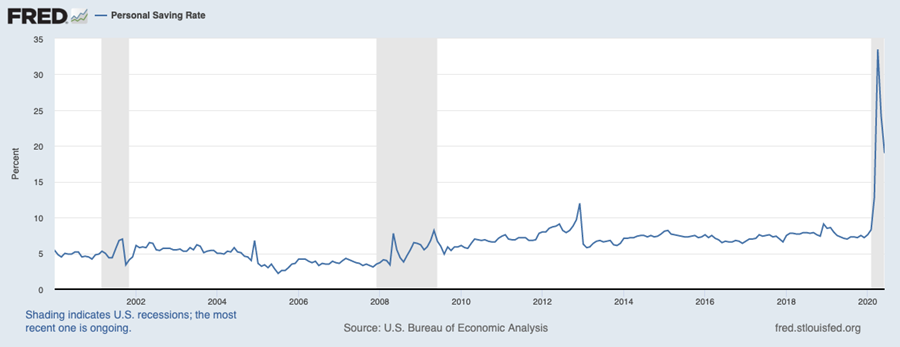

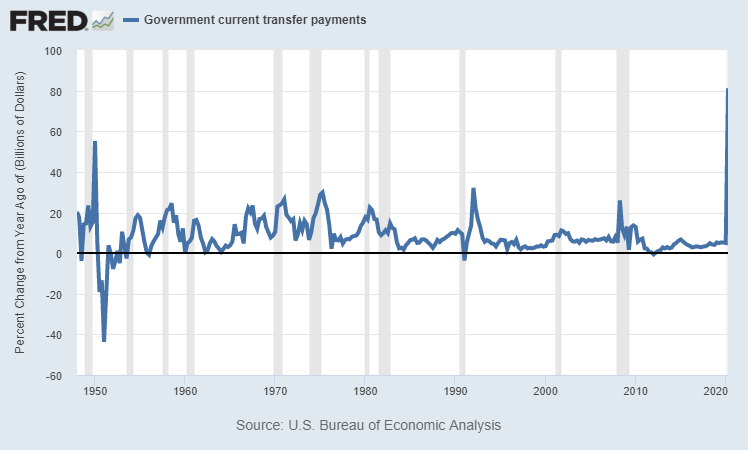

If you haven’t already buckled down for this recession, it’s not too late to start. We live in a tale of two worlds where ~32.1m now jobless Americans are receiving very significant government stimulus along with businesses in a number of ways. So, how do you prepare?

BOTTOM LINE: We’re in the midst of a recession that has largely been masked by massive government stimulus. A lot of that major stimulus is now decreasing, and it’s time to be cautious with your finances until we have more clarity.Don’t make any financial decisions that could easily backfire… consider if you have enough cash/assets to live for 12 months without a job. It’s a strong exercise in general because life does happen. Hope for the best, plan for the worst. |

|---|

Don’t just check your FICO® Score, Boost it instantly for Free For the first time ever and only with Experian, you can increase your credit scores fast by using your own positive payment history. Experian Boost is completely free, no credit card required! It can also help those with poor or limited credit situations. Other services such as credit repair may cost you up to thousands and only help remove inaccuracies from your credit report. Results may vary, see Experian.com for details |

|---|

The life of an entrepreneur is filled with ups and downs. As the saying goes, life happens. And the more successful you are, the more life happens. Every week, we’ll share some inspiration or a short story on these key make-it-or-break-it moments. The first few weeks, you’ll hear from our founder Fehzan! |

|---|

Every week, we’ll point out a few of our favorite resources/articles/news that actually provide value. Chamath Palihapitiya: Skip government bailouts, put more money ‘into the hands of consumers (6 Minute Video) – A quick background on Chamath followed by a few minutes of genius. The ‘death of valuation’ and what it could mean for investors going forward (5 Min Read) – Warren Buffett in 1967, the growing dominance of growth stocks, and one firms realistic prediction. Short and to the point. Robinhood Has Lured Young Traders, Sometimes With Devastating Results (5 Min Read)– A sobering perspective on Robinhood… maybe don’t bet the house! The stock market is not meant to be a boredom driven casino. Two-thirds of laid-off workers may temporarily be receiving more money in unemployment benefits than they did from their jobs (5 Min Read) - 68% of jobless workers brought home more money with the CARES Act unemployment benefit, and 1 in every 5 nearly doubled their lost earnings with unemployment. Why This is Unlike the Great Depression (Advanced 30 Min Read) – A great comparison to the Great Depression and why the COVID19 recession is just not the same… advanced yet highly enjoyable read. Warning: May still put you to sleep. |

|---|

What did you think of our newsletter? Let us know, your feedback will help us improve the quality of our newsletter. 1 2 3 4 5 6 7 8 9 10 Certified 20 Have more to say? Want us to cover something specific? We’d love to hear from you. |

|---|

The best way to let us know you enjoy Return On Time is to share us with your friends, family, and colleagues. Best of all, you get rewarded with free swag! |

|---|

|

|---|

BOTTOM LINE: The worst thing you can do is panic sell or sell out of existing assets thinking cash is a safe alternative. Ray Dalio says, “cash is trash” when we can press a button and print a few trillion. It’s a scary market with very serious distortions but great long term opportunities always exist. And please, don’t be a typical post-March 2020 Robinhood trader. Invest responsibly.

BOTTOM LINE: The worst thing you can do is panic sell or sell out of existing assets thinking cash is a safe alternative. Ray Dalio says, “cash is trash” when we can press a button and print a few trillion. It’s a scary market with very serious distortions but great long term opportunities always exist. And please, don’t be a typical post-March 2020 Robinhood trader. Invest responsibly.