|

Since the Great Recession, Quantitative Easing has become an increasingly popular term amongst investors. However, very few investors actually understand what Quantitative Easing, or QE, actually is. Here at ROT, we believe understanding QE is critical to growing your wealth in the 2020s.

To Start, Let’s Define Quantitative Easing

Quantitative easing is an unconventional policy implemented by central banks to buy government bonds and other financial assets to inject new money into the economy and expand economic activity. When interest rates are already cut to 0% like they are now, QE is used to further stimulate the economy out of a recession or slump. While QE was unconventional before the Great Recession, it has become common place since then across the world. However, it is worth noting that similar programs to QE were used by the Federal Reserve in the 1930s to fight off the Great Depression.

Does QE Increase Asset Prices?

Yes and no. Japan and Europe have been using QE as well. However, in both these cases, markets have been fairly stagnant. That said, QE does introduce new money into the system largely by buying up bonds. By doing so, interest rates get further suppressed even though they are already at 0%. When bond interest rates are largely below inflation, like now, investors have little incentive to invest in bonds. As a result, investors are forced to make riskier investments to generate a return on investment. So, investors really do not have a choice but to invest in stocks, private equity, venture capital, and other riskier investments. After a decade of huge US stock returns, investors have adopted the mentality to never fight the Fed. Given investor mentality, we believe QE does help push US stock and other asset prices higher than they would otherwise be.

Quantitative Easing: 2008-March 2020

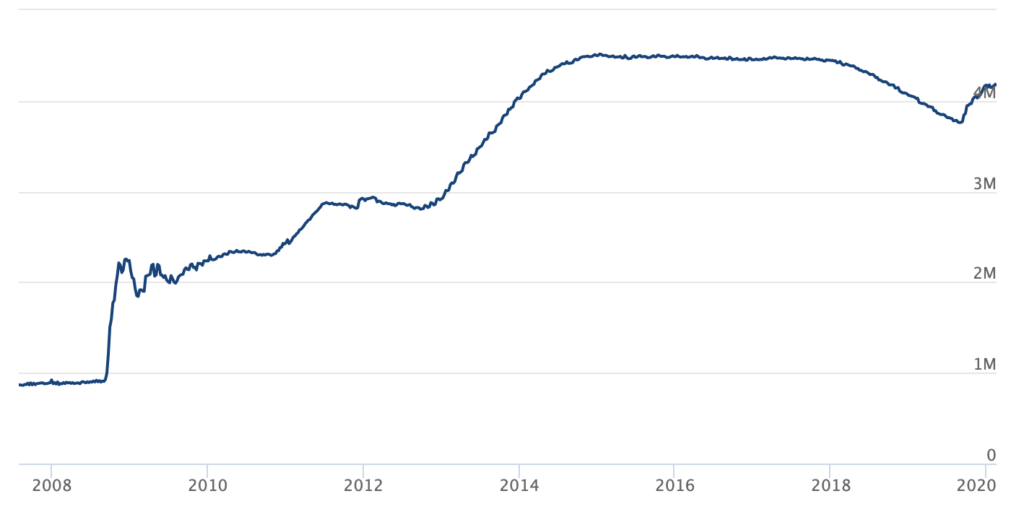

After the Great Recession, the financial system nearly collapsed due to the housing bubble. At the time, nearly anyone could buy a house whether they could afford it or not. To fight off collapse, the Federal Reserve started quantitative easing. During this time, the Fed increased their balance sheet from ~$800B TO $4.5T at its height in 2014. This primarily helped to recapitalize the banks and restore confidence in the economy. By recapitalizing banks, it helped prevent massive bank bankruptcies and allowed banks to resume lending. However, most of this printed money never actually entered the real economy. Thus, we didn’t see any real inflation. In fact, the Fed has never achieved its inflation target of 2%. Instead, reported inflation averaged about 1.6% a year during this time.

Beginning in 2018, the Federal Reserve began to reduce their balance sheet again. However, due to market forces, the Federal Reserve resumed QE in late 2019. In all cases, very little of this money actually made its way into the hands of consumers. QE 2008 to 2020 did help recapitalize banks to their best levels in decades. You can see QE from 2008 to 2020 here:

Quantitative Easing: March 2020 Onwards

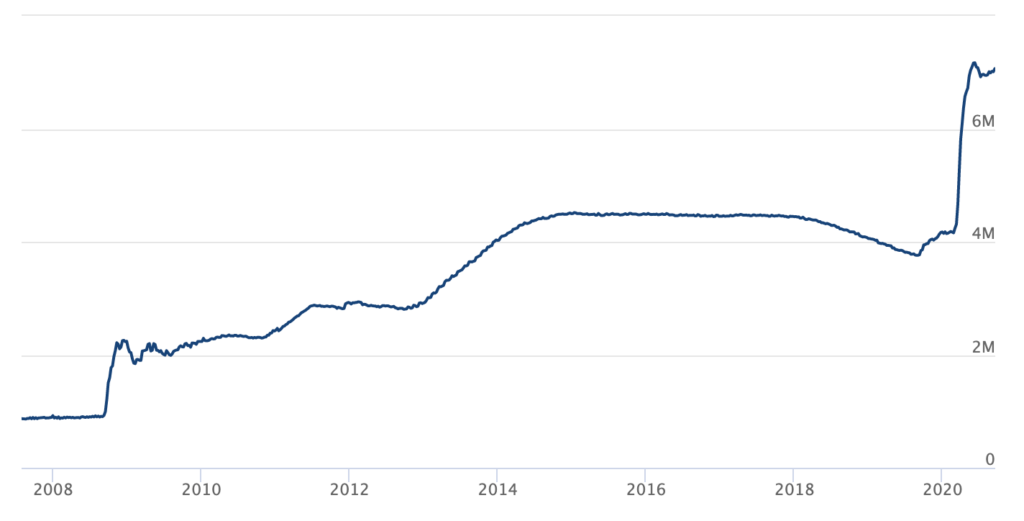

Once the pandemic started, the Federal Reserve resumed QE at an unprecedented pace. In just a matter of weeks, the Fed printed nearly $3T in new money and cut interest rates to 0% again. Given the risks of a global depression, the Fed simply did not hesitate and openly planned to bail everyone out. It became clear very quickly that this is an entirely different form of Quantitative Easing.

The key difference between QE from 2008-mid 2019 and now is that the Federal Reserve has been buying up US government debt (treasuries) to fund a massive amount of government debt. This government debt is being actively deployed into the economy via stimulus measures from the CARES Act. That stimulus is then being handed directly to consumers to spend and businesses to retain employees. Government transfer payments (basically stimulus) have sky rocketed which has allowed US household net worth to grow in the midst of a recession. This is highly abnormal. And, the Federal Reserve is ready and willing to help this type of stimulus continue along. As a result of all of this stimulus, the money supply has increased dramatically in a way we simply have not seen in any recent history. Today, You can see the massive jump in QE here:

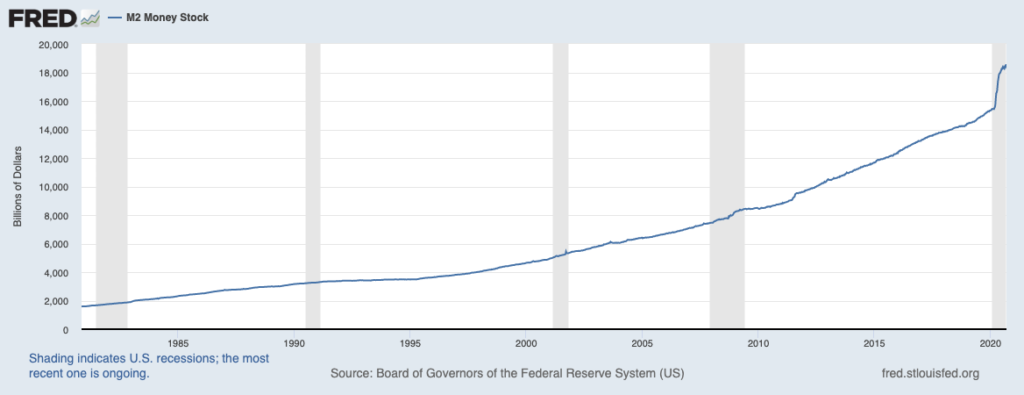

Here is the money supply (or M2):

QE 2008 Vs. 2020: The Inflationary Difference

Today, there is a real possibility for medium term inflation as a result of QE. In the short run, we may hit a deflationary scenario but the government has shown it is willing to do ANYTHING to prevent any form of collapse of the financial system. In a deflationary scenario, more money will simply be printed and handed to consumers to spend. If COVID19 does not spike this winter and the economy continues to return to “normal”, we may bypass deflation and head relatively quickly into inflation. Given the high unemployment rate that is likely to persist for years, we further believe that we’re likely to enter stagflation. Stagflation occurs when there is high inflation combined with stagnation in the economy like high unemployment.

Bottom Line

QE 2020 is quite literally nothing like QE 2008 to early 2020. Today, Quantitative Easing is largely being used to fund government debt with newly created money. The Federal Reserve is keen to achieve inflation in any way that it can. In addition, politicians are more than happy to pass massive stimulus as needed. As a result, the money supply has dramatically increased. If there is any serious spike in COVID cases, the Fed will simply print more and further increase the money supply. Given this, we believe that inflation is likely to roar back 3-5 years from now, or possibly sooner.

|

|---|