|

This year, Tesla has garnered a lot of attention as its stock price has gone from ~ $220 per share in August 2019 to $2,375.65 (or $475.13 after the 5-for-1 stock split on August 31st) as of September 1st, 2020. If you invested in Tesla just a year ago, you would have a mind boggling return of 1004.38%. Put another way, if you invested $10,000 in Tesla in August 2019, your investment would be worth a bit over $100,000 just a year later. Just take a look at this 5 year chart and you can clearly see just how wild the ride has been:

Moreover, Tesla excitement isn’t letting up yet and as a Tesla car owner, it makes complete sense why. Elon Musk is one of the greatest visionaries of our time which has allowed him to attract a massive fan base, whether it’s with Tesla, SpaceX, or another one of his wild startups. As a car, the Tesla is a carefully crafted work of art paired with an incredible amount of data to drive the vision forward. If you’ve had the opportunity to drive a Tesla, you already know what I’m talking about. If you haven’t driven the Tesla yet, please demo this car and see for yourself.

However, there is one big question. Is a Tesla share worth the $2,375.65 price (or $475.13 after the 5-for-1 stock split) in September 2020? Let’s find out!

Tesla Stock Price Put Into Perspective

There is a few ways to look at the current Tesla stock price. Firstly, at $2,375.65 (or $475.13 post split) per share, Tesla is valued at nearly $464 billion dollars. For the sake of comparison, Toyota is currently valued at $185 billion dollars. In 2019, Toyota generated $290.1 billion in revenue while Tesla generated $24.6 billion in revenue. Secondly, Tesla is now worth more than Ford, Volkswagen, Ford, General Motors, and Honda combined. Thirdly, and most importantly, the current Price to Earnings (PE) ratio is 1,146. Meaning, investors are willing to pay $1,146 for every $1 in earnings. Put another way, investors buying Tesla stock today are willing to pay for 1,231 years worth of the last 12 months of profits. For some additional perspective, Amazon’s PE ratio is currently 130 or 9.2x lower than Tesla.

What’s Driving Tesla Higher?

At first glance, you’re likely to assume Tesla is growing its revenue and profits rapidly. Let’s take a deeper dive and see if that’s true!

Revenue and Profits

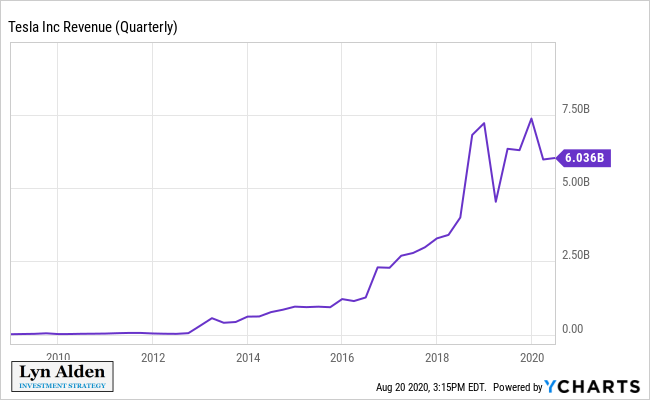

Thus, the new price gains are not driven by revenue growth at this point. Tesla has seen significant growth in revenues and profits between 2016 and now. However, Tesla revenue has been roughly flat since late 2018. In Q4 2018, Tesla generated $7.2B in revenue. In Q2 2020, Tesla generated $6.036B in revenue. In fact, Tesla has slashed prices on their cars a few times this year since the COVID19 pandemic started. Of course, investors expect that Tesla revenue and profits will grow dramatically at some point in the future.

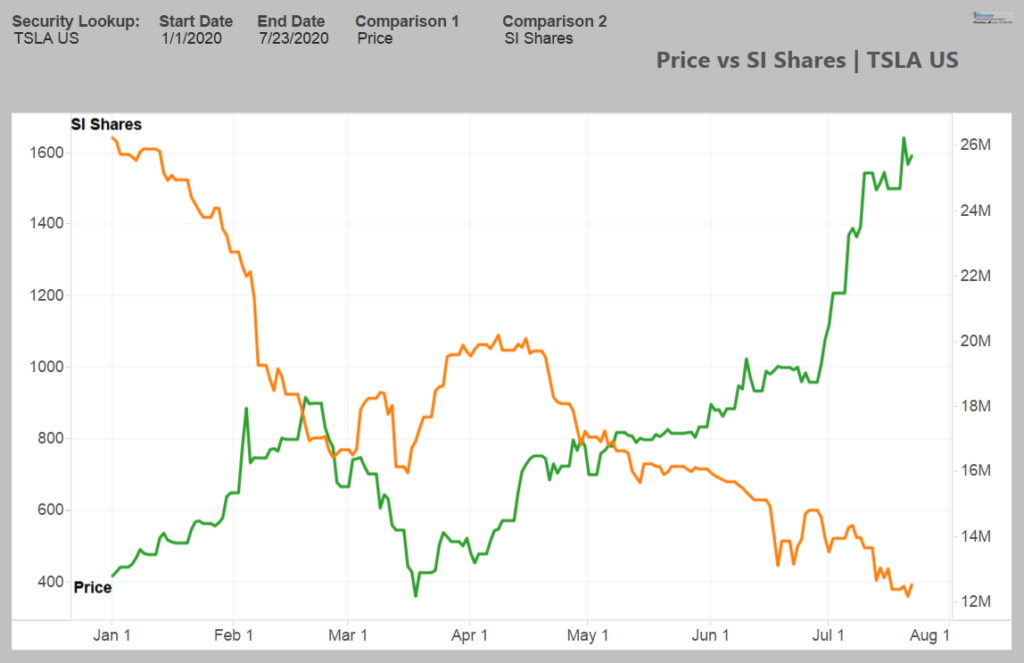

Massive Short Squeeze

In part, a massive short squeeze has driven Tesla prices this year. A short squeeze is driven by traders/investors who bet that Tesla share prices will fall by buying options. Instead, as Tesla’s price has continued to rise, those same investors have to actually buy Tesla stock in order to stop greater losses. According to S3, a fin tech company, Tesla has been in a massive short squeeze for all of 2020 with 13.82 million short shares, worth $22 billion, covered since December 31st, 2019 as of July 23rd, 2020. Take a look at this chart by S3 that shows the clear correlation between short interest (aka investors betting against Tesla) in orange relative to share price (green).

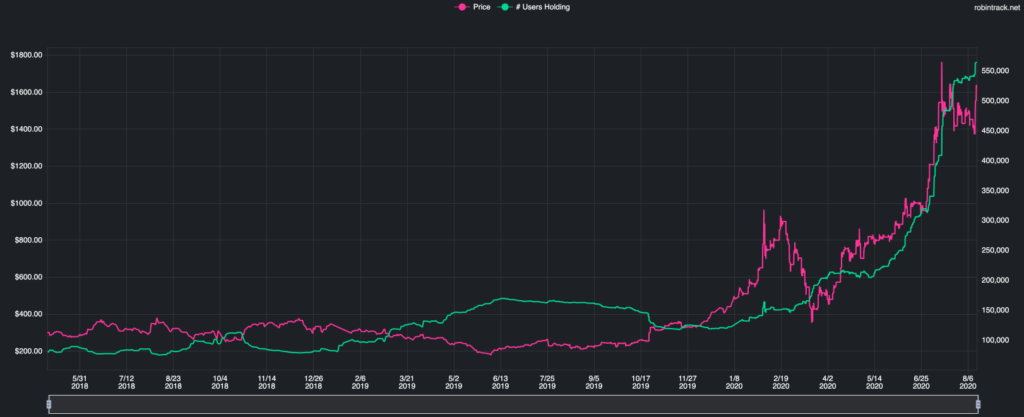

Robinhood Retail Traders

Robinhood has gained notoriety since the pandemic as retail investors have increasingly signed up and started trading a number of stocks. Tesla has certainly been a beneficiary of Robinhood investors. While Robinhood is no longer allowing access to some of their trading data, between March 2020 and August 13th, 2020, the number of Robinhood traders that hold Tesla has gone from 149,914 to 563,621 or a 376% increase. Visualize it – the green line is Robinhood traders whereas the purple line is the share price:

5 For 1 Stock Split & Potential S&P500 Inclusion

Firstly, Tesla just executed a 5-for-1 stock split on August 31st, 2020. Simply put, a 5 for 1 stock split increases the number of shares by 5. So, for every one share you hold, you now hold 5. By doing this, Tesla makes their stock more accessible to investors who can buy 1 share for $475.13 instead of $2,375.65+. Secondly, Tesla is very likely to join the S&P500 index in the coming months. The company just cleared a major hurdle to join the S&P500 by reporting its fourth straight quarterly GAAP profit. The S&P500 is the most popular stock market index in the US today. In addition, given that many investors simply buy and hold S&P500 passive ETFs today, Tesla will gain a potentially significant number of new investors.

Bottom Line: Should You Buy Tesla Stock Today?

|

|---|