|

The world has changed dramatically and the 60/40 portfolio (60% stocks, 40% bonds) simply doesn’t cut it anymore. In fact, we’d argue that bonds are a pretty risky proposition nowadays. Given that the Federal Reserve is doubling down on creating inflation in the 2020s, it’s pretty difficult to bet against the Fed. In fact, they are printing trillions of dollars in an effort to stave off deflation and increase inflation. We anticipate that they will succeed in the mid to late 2020s.

The Premise Behind a 60/40 Portfolio

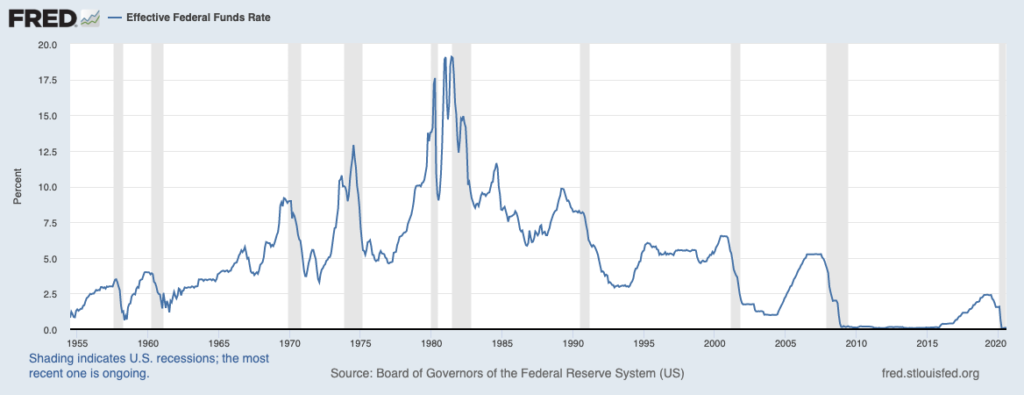

Typically, bonds have provided downside protection during a recession. During a recession, the Federal Reserve cuts interest rates to stimulate the economy. Furthermore, bond prices tend to increase as bond yields fall due to the rate cuts and the general fear in the markets. This helps offset some of your losses in stocks during a bear market as the total value of your bonds increase. In addition, you still get paid interest to hold onto those bonds. When interest rates were at nearly 20% in the 1980s, this made a lot of sense. After the Great Recession, the 60/40 portfolio still made general sense as Treasury yields were still significantly higher than today even though rates went to 0%. Here is the Federal Reserve Effective Funds Rate over time:

Bond Yields Are Simply Too Low

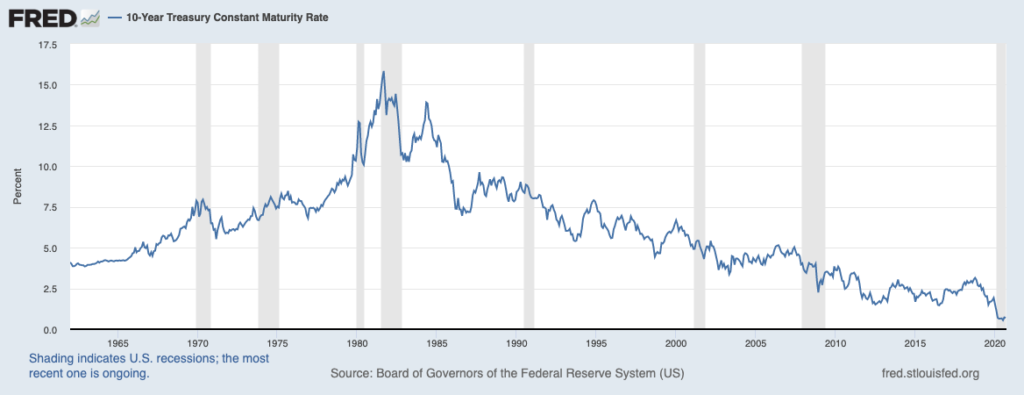

Today, bond yields are mind bogglingly low. In many cases, bond yields are below inflation. Thus, your money still loses value over time. With interest rates at 0% and market risks higher than ever, bonds are unlikely to provide the same level of protection in the 2020s as previous decades. After all, how much lower can bond yields go? We’ve already seen that negative interest rates DO NOT work. While it is possible Treasury rates will decline further, there simply is not much room. You can see here the interest rate on a 10 year US Treasury over time:

Peak Zero Rates

Inflation is dead. Long live inflation! Investors today do not believe that sustainable inflation will ever occur. Now more than ever, investors sing the chorus that stocks are worth infinity because interest rates are 0%. While they may not be wrong in the short term, any whiffs of inflation will be absolutely destructive to both stocks and bonds. With inflation, bond prices will need to fall as yields rise and stock prices will also generally decline. Furthermore, with inflation, many of the loved growth stocks are likely to fall in an outsized manner. Thus, your average 60/40 portfolio is likely to fall in tandem.

What Happens If We Get Inflation

The Federal Reserve is hell bent on creating inflation, period. Coincidentally, the pandemic has given the Fed a way to directly create that inflation. Since March 2020, the Fed has aggressively purchased US government debt to distribute that stimulus to every day Americans. As mentioned, if they succeed, yields will climb and bond prices will fall eventually. Herein lies the risks, what happens to bond holders when inflation takes off? Given that stock valuations are the second highest in US history after the Dot Com Bubble and much of this is driven by low interest rates, what happens to stock investors when inflation takes off?

The 60/40 Alternative In The 2020s

Given the extreme level of uncertainty in the 2020s, investing is all about diversification. During the pandemic, we have continued risks of a COVID19 spike that leads to stunted economic growth again. In this case, the Fed will simply print more money and the government will take on more debt. The more money we print and the more debt we take, the more we need inflation. Why? Because we need to pay off the ginormous debt by reducing the value of money significantly over time. Worth noting, all of this money printing also exceeds any other country to date. Thus, the US Dollar has lost 11% of its value since March 2020 against most major currencies. So, diversification is absolutely critical. It’s important to consider emerging markets vs. developed non-US markets vs. US markets, domestic bonds vs. international bonds, hard assets like real estate vs. gold/silver vs. commodities like oil, growth stocks vs. value stocks, etc. By finding the right mix of assets for your portfolio, you can position yourself better to preserve and grow your wealth. Some of the Robo Advisors already build portfolios that allow you to diversify better than your typical 60/40 portfolio.

Bottom Line

Investing in the 2020s is going to be a lot more difficult than previous decades. To stay ahead of the curve, consider a highly diversified portfolio that allows you to account for various scenarios and protect/grow your wealth during this time. A simplified 60/40 stock/bond portfolio simply won’t cut it anymore. Investors that take this approach and consider the various scenarios are likely to perform well, while investors that double down on highly overvalued stocks are likely to generate poor or negative returns over the next 10 years.

|

|---|