|

One of the open secrets to growing your wealth is understanding inflation. Yet, most people don’t really understand it. We know that things were much cheaper a few decades ago, but we don’t always grasp how it erodes our purchasing power over time.

Let’s Define Inflation

So, what is inflation? Inflation is an economic condition that refers to generally rising prices of goods and services within a particular economy. More specifically, in the US, the Bureau of Labor Statistics (BLS) measures inflation using the Consumer Price Index (CPI).

The CPI measures the weighted average of prices of a basket of common consumer good and services. Every month, the BLS surveys the prices of 80,000 consumer items to create the index. The CPI includes food, energy, commodities, housing, health care, transportation, and other services. Learn more on the BLS CPI FAQ. Inflation typically occurs when the supply of money is greater than the demand for money. Moreover, controlled inflation is generally viewed positively as it helps drive economic growth.

The Federal Reserve has a goal of 2% inflation per year to ensure a healthy economy.

Why Is Understanding Inflation Important?

Inflation erodes the value of money over time. Meaning, $1 in 2010 can purchase the same amount of goods as $1.19 in 2020. Put another way, $1 in 2020 has the same value as $0.83 in 2010. By understanding this, you can plan to generate a return at or greater than inflation so you do not lose purchasing power. If you kept your money in a bank account the last 10 years, you will have lost significant purchasing power because interest rates on savings accounts have been ultra low since the Great Recession.

Savers Lose.

Since interest rates have been below inflation for most of the time since 2008, savers have been losing purchasing power if they are not actively investing. In many cases, conservative investors have also lost purchasing power by holding onto bonds that have also generally been providing returns below inflation. In our new world of 0% rates and high levels of money printing for the indefinite future, it’s important now more than ever to protect your savings AND grow your wealth.

Real Inflation Is Likely Much Higher

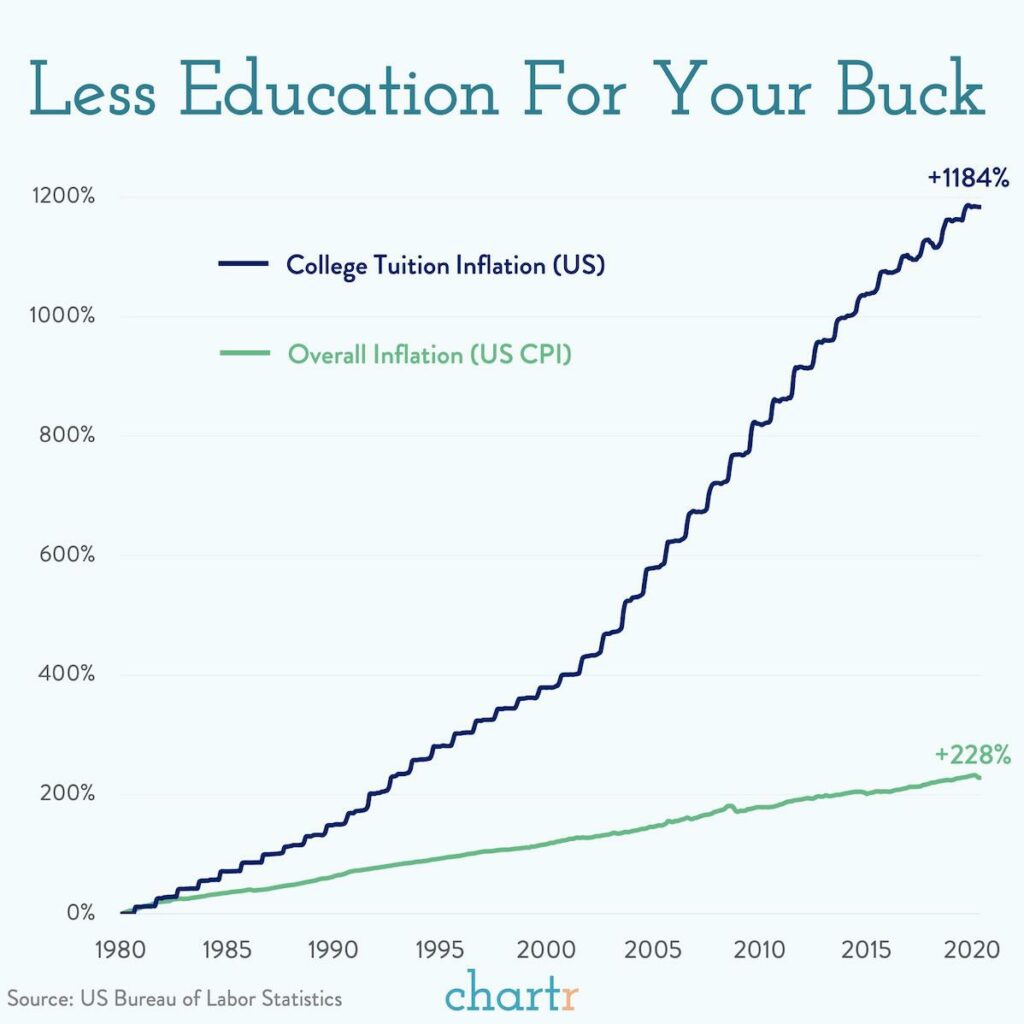

The Federal Reserve has been concerned that inflation has been below the 2% CPI goal per year since the Great Recession. However, the CPI fails to measure very important factors in cost of living such as asset inflation. Asset inflation refers to the rise in price of assets, such as stocks, real estate, and other investments. Since interest rates were cut to 0% in 2008, asset inflation has rapidly increased. In addition, some of the most expensive costs like rent, healthcare, and college tuition are underrepresented in inflation measures yet very dramatically increase our cost of living over time. So, beating CPI inflation is not enough. We need to generate a return above inflation. For example, since 1980, college tuition has increased by 1184% while overall inflation has increased by 228%. Visualize it:

Make Inflation Work For You

When you understand inflation, you can create a plan to ensure your savings do not lose value. Moreover, by understanding inflation and the value of productive debt, you can grow your net worth by acquiring assets such as stocks, real estate, and other investments. Generally speaking, the more assets you own, the more likely you are to build your wealth and grow your purchasing power, even after inflation. For example, the S&P500 has historically returned 7% after inflation. In addition, acquiring assets utilizing carefully planned productive debt allows you to build wealth even faster. This is because inflation makes it easier to pay back debt over time as money loses value and incomes increase.

BOTTOM LINE: Inflation Is An Important Concept To Grow Your Wealth

By understanding inflation, you can learn a key foundational concept to build, grow, and keep your wealth over time. The wealthy know that our economic engine is built this way. Thus, they have been growing their wealth long term by investing in assets that generate returns greater than inflation for a long time.

|

|---|