Welcome to all of our new subscribers! This week, we share 3 stocks that we believe will benefit from the recovery, we take a look at how the recovery is going, and share our top 5 rewards credit cards this month.

Trivia Question: What stock is worth more than the entire European stock market combined? Scroll to the bottom for the answer. |

|---|

Click here if these just look like random letters to you!

VALUATIONS MATTER: Top 4 US equity market valuation indicators, updated weekly with commentary.

Tesla Tanks. Last week, we analyzed Tesla stock and if you should invest after sharing the data. Our answer was a definite no, but we understand FOMO is hard to overcome (even for ourselves) so we recommended dollar cost averaging for anyone looking to quickly invest into Tesla. The last few days, Tesla stock has dropped nearly 34%. Even at these prices, Tesla’s valuation remains elevated. Given this, we would not be surprised if Tesla has much further to fall even if it climbs upwards in the short term. Pandemic Winners. Most of the stock gains since the pandemic started have been driven by stocks that are large beneficiaries of a shut down. Think Netflix, Zoom, Facebook, Google, Amazon, etc. However, we believe these stocks are now valued far above fair value. Even if their respective businesses continue growing, it will take time for these companies to grow into their new valuations.

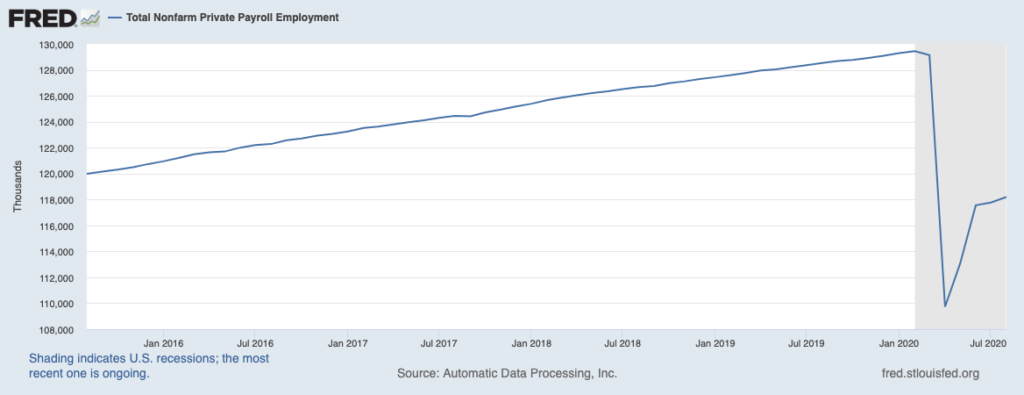

Front Running The Recovery. Investors are handsomely rewarded for taking risks during periods of high uncertainty. As we’ve seen since the March 2020 crash, investors that deployed their cash despite the doom and gloom have been rewarded for selecting companies that benefited during the pandemic. Today, investors can still make a bet on the long term recovery of the economy by investing in fairly valued stocks that will benefit from a return to normal. We understand that there is a lot of fear about a potential flu and COVID outbreak this winter. However, we know today that wearing masks and maintaining some social distance does generally work. Furthermore, we show clear signs that the economy is recovering. Moreover, American ingenuity is still alive and well. We think it’s time to make a bigger bet on the US recovery by carefully selecting high quality investments that will perform well during this recovery. So, while it’s plausible the recovery may gain or lose steam based on waves of COVID outbreaks, we do not see a scenario where the economy will fully shut down again.

3 Recovery Stocks We Are Investing In. As we look at the recovery, we are looking to invest long term in beneficiaries of a post pandemic world at fair valuations. However, it is important to be careful and avoid landmines. For example, investing in companies that are heavily focused on commercial real estate are likely to struggle well past the recovery. Clearly, the whole world is rethinking remote and office work. Without further ado, these are our top picks for the recovery:

Slack Technologies (WORK) – Slack is high growth tech company that has serious tailwinds and a relatively more reasonable valuation than most tech companies. As the recovery continues, we believe Slack’s collaboration software will benefit from structural shifts in work.

Vanguard High Dividend Yield Index Fund ETF (VYM) – VYM is a high dividend yield ETF that invests in US stocks primarily. VYM has a 4% dividend yield currently and has held up relatively well during the pandemic.

STORE Capital (STOR) – STOR is a net lease REIT with great diversification, a 5% dividend yield, and serious upside during the recovery.

DIVE DEEPER: Find Out Why We Like Slack, VYM, and STORE Capital… Keep Reading ➡️

BOTTOM LINE: The death of non-tech businesses is greatly exaggerated. While the pandemic will leave permanent changes in the economy, we continue to believe that there are a significant number of companies that will greatly benefit from a return to a [new] normal. That said, given various bubbles in the stock market, we are investing utilizing a dollar cost averaging strategy to buy at the best possible prices over time. |

|---|

|

|---|

We’re all about making money from our money, even from credit card rewards. When you pay your credit card balance in full every month, credit cards are a nice way to generate rewards. Normally, we maximize our points with travel rewards. However, given the pandemic, we’ve been looking at the best cash back AND travel rewards cards. Here is our top 5 rewards credits cards as of September 2020.

No Fee Card, Huge Cash Back (Excellent Credit)

Citi Double Cash – This is a no annual fee card that incentivizes you with cash to pay back your bill as quick as possible. With Citi Double Cash, you earn 2% cash back: 1% cash back on all purchases and 1% cash back when you pay the bill in full. Also, Citi is currently running a 0% APR promotion for the first 18 months. Learn more about Citi Double Cash.

Low Fee Card For Moderate Travelers (Excellent Credit)

Chase Sapphire Preferred – For a limited time, Chase is offering 60,000 bonus points for signing up as a new customer and spending $4,000 within 3 months. This is an attractive card because your points are worth 25% more when you redeem for travel through Chase’s Ultimate Rewards program. Thus, 60,000 bonus points is worth $750 in travel. Until September 30th, Chase is now allowing customers to redeem points for grocery stores, dining establishments, and home improvement stores for 1.25 cents per point. As a result, 60,000 points can be redeemed for $750 in cash back. In addition to points, you will earn 2x points on travel and dining worldwide along with a complimentary DoorDash subscription for $0 delivery fee and reduced service fees. Better yet, the annual fee is an affordable $95. Learn more about Chase Sapphire Preferred.

No Fee Card, 1.5% Cash Back (Excellent Credit)

Chase Freedom Unlimited – This is a no fee card with a $200 bonus for new customers spending $500 within 3 months. Chase Freedom earns you 1.5% unlimited cash back on all purchases with no minimum to redeem. For a $0 annual fee card, Chase Freedom Unlimited packs a punch. Learn more about Chase Freedom Unlimited.

Secured Card, High Cash Back (Bad Credit)

Discover it® Secured – Having trouble with your credit? Discover it® Secured is a great way to begin rebuilding your score. With Discover it® Secured, you earn 2% cash back on up to $1,000 worth of spending per quarter on restaurants and gas. In addition, you still earn 1% on all other spending. As a secured card, you must make a security deposit between $200 and $2,500 to establish your credit line. After 8 months, Discover will evaluate you for an upgrade to an unsecured card. You earn rewards while improving your credit score. Learn more about Discover it® Secured.

No Fee Card, High Cash Back For Businesses

Capital One® Spark® Cash for Business – A ROT favorite, the Capital One Spark is a great card for 2% cash back on all business purchases. In addition, this card has no annual fee for the first year and $95 a year thereafter. For a limited time, you will earn a $500 cash bonus once you spend $4,500 in the first 3 months. During the pandemic, a straight 2% cash back card is more valuable to us than travel points given that business travel is severely disrupted. Learn more about Capital One Spark Cash.

BOTTOM LINE: Rewards credit cards are a great way to earn some extra cash if you are paying your balance in full every month. If you still have credit card debt, read this first. If you are paying your balance in full, these are some of our favorite rewards credit cards in September 2020 to maximize your rewards.

|

|---|

Don’t just check your FICO® Score, Boost it instantly for Free For the first time ever and only with Experian, you can increase your credit scores fast by using your own positive payment history. Experian Boost is completely free, no credit card required! It can also help those with poor or limited credit situations. Other services such as credit repair may cost you up to thousands and only help remove inaccuracies from your credit report. Results may vary, see Experian.com for details |

|---|

Every week, we point out a few of our favorite resources/articles/news that actually provide value.

As a shocking surprise to many, Tesla was not added to the S&P500 index. Talk about broken dreams.

Fed Chair Powell continues to asks Americans wear masks and follow social distancing for their economy.

Japanese billionaire Yusaka Maezawa loses $41M day trading and admits he knows nothing. Wow!

|

|---|

What did you think of our newsletter? Let us know, your feedback will help us improve the quality of our newsletter. 1 2 3 4 5 6 7 8 9 10 Certified 20 Have more to say? Want us to cover something specific? We’d love to hear from you. |

|---|

The best way to let us know you enjoy Return On Time is to share us with your friends, family, and colleagues. Best of all, you get rewarded with free swag! |

|---|

Answer: Apple.

Fun Fact: Apple nearly went out of business in the late 1990s. Thankfully, they brought Steve Jobs back on board who led the company to the vision it continues to execute to this day.

|

|---|

Are there any topics you want us to specifically cover? Do you have a question that ROT can help answer? It’s all anonymous. We’ll cover it in a future newsletter. Ask away. |

|---|

|

|---|