The 60/40 portfolio is officially dead. Bonds are risky, stocks are risky. So, what’s an investor to do in a risky world?

Trivia Question: What is the first recorded bubble in history? Scroll to the bottom for the answer. |

|---|

Click here if these just look like random letters to you!

VALUATIONS MATTER: Top 4 US equity market valuation indicators, updated weekly with commentary.

🆕 The 60/40 Portfolio Is Dead. Investing in the 2020s is going to be a lot more difficult than previous decades. To stay ahead of the curve, consider a highly diversified portfolio that allows you to account for various scenarios and protect/grow your wealth during this time.

DIVE DEEPER: Find out why the 60/40 portfolio is dead and how you can stay ahead of the curve ➡️

Build Wealth With Set & Forget Investing. Many investors are just looking for a way to generate consistent investment returns long term with minimal management to build wealth. By utilizing robo advisors, you can build wealth long term with minimal time invested.

Ready to build wealth with set & forget investing? Keep Reading ➡️

|

|---|

|

|---|

🆕 Top 5 Savings Accounts/No Penalty CD Rates. While savings interest rates are very low nationally, there are a few online banks that offer significantly better interest rates while still giving you easy access to your money whenever you need it. Online savings accounts are an easy way to earn interest on cash that you are saving up for a big expense like a down payment on a home or even just your emergency savings. Check out our top 5 savings accounts/no penalty CDs.

Top 5 Rewards Credit Cards. Make your credit card work for you when you pay the balance in full every month. By thoughtfully picking credit cards, you can earn rewards redeemable for serious cash back, travel, or other rewards. Check out our top 5 rewards credit cards in September 2020.

|

|---|

Don’t just check your FICO® Score, Boost it instantly for Free For the first time ever and only with Experian, you can increase your credit scores fast by using your own positive payment history. Experian Boost is completely free, no credit card required! It can also help those with poor or limited credit situations. Other services such as credit repair may cost you up to thousands and only help remove inaccuracies from your credit report. Results may vary, see Experian.com for details |

|---|

Every week, we point out a few of our favorite resources/articles/news that actually provide value.

If wages had kept up with inflation the last few decades, the average full time salary in America would be $102,000.

Ray Dalio warns the US is in a period of great risk. His primary thought? Diversify!

Nikola’s hyped stock craters after founder Trevor Milton forcefully resigns. Find out what prompted the resignation over the weekend.

|

|---|

What did you think of our newsletter? Let us know, your feedback will help us improve the quality of our newsletter. 1 2 3 4 5 6 7 8 9 10 Certified 20 Have more to say? Want us to cover something specific? We’d love to hear from you. |

|---|

The best way to let us know you enjoy Return On Time is to share us with your friends, family, and colleagues. Best of all, you get rewarded with free swag! |

|---|

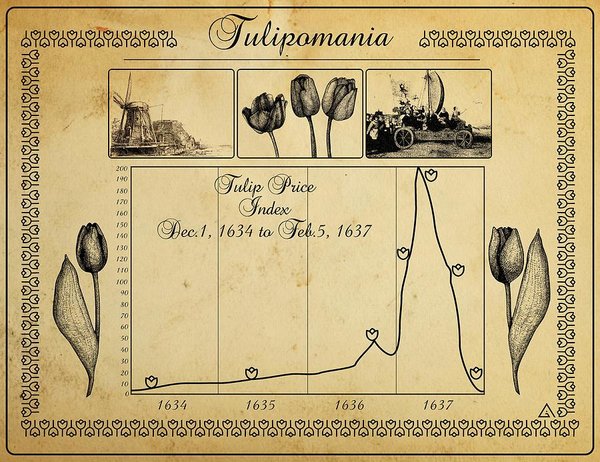

Answer: Tulip Mania

Fun Fact: Between 1634 and 1637, the price of tulip bulbs skyrocketed to over 100 times gold. Within the same year, the price of tulip bulbs dropped below 1634 levels.

|

|---|

Are there any topics you want us to specifically cover? Do you have a question that ROT can help answer? It’s all anonymous. We’ll cover it in a future newsletter. Ask away. |

|---|

|

|---|